Table of Contents

- TSP Combat Zone Contributions

- How TSP Contributions Work in a Tax-Exempt Zone

- How to Use Combat Zone TSP Contributions to Maximum Advantage

- Why would anyone want to contribute $69,000/year to their TSP?!?

- Combat Zones

- What’s the Annual Addition Limit?

- How to reach the Annual Additions Limit

- The Roth TSP annual contribution limit is still $23,000

- If You’re In The BRS… then leave room in your Roth TSP for your monthly contributions

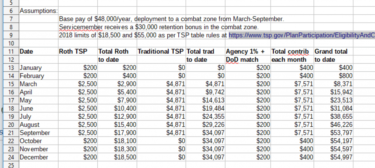

- Example: contributing $55,000 in 2018 to the TSP from a combat zone with the DoD BRS match

- What If You’re Still In The Legacy High Three Pension System?

- Note for “older” servicemembers

- A Friendly Little Note From The IRS

- Your Call To Action:

You can contribute up to $23,00 to your Thrift Savings Plan in 2024. These contributions can go into your Roth or Traditional TSP, or in any combination of the two, as long as they don’t exceed $23,000.

This $23,000 elective deferral limit only applies to your payroll contributions and does not include Department of Defense agency matching contributions from participating in the Blended Retirement System. If you contribute at least 5% of your base pay into your TSP every month of the year, then the DoD will match up to 5% of your base pay all year. These matching contributions count toward the Annual Addition Limit (see chart below).

Ready for some good news?

When you deploy, you can contribute far more than the $23,000 elective deferral limit. If you do it right, you can contribute up to the $69,000 Annual Addition Limit.

The following table shows current TSP contribution limits with more details. And if you stick around, we’ll show you how to maximize your TSP contributions in a combat zone:

| 2024 Thrift Savings Plan Limits | Maximum Contribution | Internal Revenue Code | Notes |

|---|---|---|---|

| Elective Deferral Limit | $23,000 | IRC §402(g) | Applies to the combined total of traditional and Roth contributions. For members of the uniformed services, this limit encompasses contributions from taxable basic pay, incentive pay, special pay and bonus pay. However, it does not apply to traditional contributions from tax-exempt income earned in a combat zone. |

| Maximum Annual Addition Limit | $69,000 | IRC §415(c) | Applies to the total amount of all contributions (per employer) made on behalf of an employee in a calendar year. This limit includes employee contributions (tax-deferred, after-tax and tax-exempt), agency/service automatic (1%) contributions and matching contributions. For 415(c) purposes, working for multiple federal agencies or services in the same year is considered having one employer. |

| Catch-Up Contribution Limit | $7,500 | IRC §414(v) | The maximum amount of annual catch-up contributions for participants age 50 and older. Catch-up contributions are separate from elective deferral and annual addition limits imposed on regular employee contributions. |

TSP Combat Zone Contributions

Because so many military families have learned the basics of contributing to the TSP, we’re getting a lot of questions about maximizing those contributions during deployments to combat zones.

Military pay in a combat zone is exempt from federal and state taxes, and servicemembers are also eligible for much higher contributions to the TSP. I’ll get into the gory details during this post, but for now, I’ll mention that the annual additions limit of the tax code is $69,000/year in 2024. That limit applies even when you’re not in the combat zone for the entire year! *

[* Note: That last sentence means your higher limits are still available if your deployment is less than the full calendar year. If you’re in the Blended Retirement System, you need to keep reading about leaving room in your Roth TSP for 12 months of contributions.]

How TSP Contributions Work in a Tax-Exempt Zone

Your pay and benefits are tax-exempt when in a combat zone. This gives you special tax treatment for TSP contributions.

- Roth TSP contributions before, during, and after your time in a tax-exempt zone count toward the elective deferral limit ($23,000).

- Traditional TSP contributions made before or after being in a tax-exempt zone count toward the elective deferral limit ($23,000).

- Traditional TSP contributions made while in a tax-exempt zone are listed as “Traditional tax-exempt contributions” and only count toward the annual addition limit ($69,000).

- DoD matching contributions count toward the annual addition limit ($69,000).

Note: The TSP will shut off all contributions once you reach the $23,000 elective deferral limit.

These contribution rules present unique opportunities that require planning before, during, and after your time in the combat zone. This is especially important for Blended Retirement System participants who receive matching contributions. We’ll run through some examples in this article to show you how to maximize your contributions through the end of the year.

Ensure you plan accordingly when making your TSP contribution elections in myPay (or Marine OnLine).

How to Use Combat Zone TSP Contributions to Maximum Advantage

IRS rules allow military members to contribute up to the annual addition limit of $69,000 when serving in a tax-exempt zone.

Later in this post, I’ll also answer the question that most of you are thinking about right now:

Hey Nords, I just checked my Leave and Earnings Statement, and, golly dude, I’m not getting paid $66K this *year*– let alone during this deployment. I have expenses, too. Where the heck are people getting the money for this?!?”

We’ll address that issue in excruciating detail (military families are extremely creative), but the basic response is, “Do the best you can with what you have.” You’ll be surprised at how much the DoD and the IRS will help you reach that goal, and this post includes the links to ensure it applies to you.

Let’s be clear: I would not volunteer to deploy to a combat zone just for the tax-free pay (and the special pay) and the higher contribution limits to retirement accounts. I would not even do it to pay off student loans or consumer debt. Yet that combat zone is why you joined the military, and as long as you’re there, you might as well make the most of your pay advantages.

But that leads to a good question.

Why would anyone want to contribute $69,000/year to their TSP?!?

Short answer: the TSP has some of the world’s largest passively managed index funds with some of the world’s lowest expense ratios. You can get tax-deferred compounding and tax-free withdrawals depending on how you contribute. You don’t even have to wait until age 59.5 to tap your TSP.

The TSP is one of several investing answers, but it should be a big part of every military family’s asset allocation plan. (Some might decide it’s the best part.) In the combat zone, you’re putting tax-free pay into the TSP. This offers a huge compounding advantage and means you have more money to contribute to your TSP account instead of “contributing” it to the U.S. Treasury’s income-tax fund via withholding and tax returns.

Finally (stay with me here), combat deployments are not exactly fun. (Not even submarine deployments.) We personal finance bloggers talk boldly about frugality versus deprivation and work-life balance, but let’s not kid ourselves: this deployment will be more work than life and a lot more deprivation. As long as you’re embracing the suck, you can still extract some value from the pain by investing as much as possible toward your financial independence life goal.

For a few of us, maximizing TSP contributions *during* a deployment is a great way to minimize lifestyle expansion *after * a deployment. Yeah, you worked hard, and you deserve a nice reward. Instead of a dollar-gobbling depreciating pile of a pickup truck, how about sleeping better at night knowing you’re on track for financial independence? Sure, give yourself a small victory lap party, but avoid the temptation of the hedonic treadmill by putting most of that money where it’s hard to frit away.

No worries, this post includes a detailed year-round example. I also have a spreadsheet for you to edit with your own numbers.

Next question: where are these combat zones?

Surprisingly, they don’t all involve actual combat. I hope.

Combat Zones

DoD and the Internal Revenue Service work with Congress to define combat zones. Here’s the text straight from the IRS press release:

The term ‘combat zone(s)’ is a general term used on IRS.gov and includes all of the following hostile areas where military may serve: actual combat areas, direct combat support areas, and contingency operations areas.”

(source)

I was surprised to learn that Djibouti, the Philippines, and even the Sinai Peninsula are eligible for combat zone benefits. The distinction is not whether you’re shooting but rather whether you could be shooting or whether you’re helping other people shoot. You’re also supposed to be getting imminent danger pay or hostile fire pay.

According to the IRS, there are three options:

- Service in an active combat area as designated by Executive Order, and receive special pay for duty subject to hostile fire or imminent danger as certified by DoD.

- Service in a support area as designated by DoD in direct sustainment of military operations in the combat zone, and receive special pay for duty subject to hostile fire or imminent danger as certified by DoD.

- Service in a contingency operation as designated by DoD, and receive special pay for duty subject to hostile fire or imminent danger as certified by DoD.

Read the fine print in the IRS notice, but if you’re getting that pay on deployment, then you’re probably eligible for the tax code’s annual additions limit to your TSP: $69,000/year in 2024.

What’s the Annual Addition Limit?

What does that limit look like? Review the chart at the top of the page again.

Here’s the important fine print from that chart:

This limit… includes employee contributions (tax-deferred, after-tax, and tax-exempt), Agency/Service Automatic (1%) Contributions, and Matching Contributions.”

In other words, that $69,000 limit now includes your DoD BRS agency/matching contributions. You’re not actually contributing all of that limit from your pay.

How to reach the Annual Additions Limit

- Because that limit includes the BRS agency/matching contributions, you must dial back your contributions to allow for DoD’s 5% match of your base pay. To make things even more complicated for the BRS, you’ll have to spread your 5% contributions across all 12 months of the calendar year, or you’ll miss some of the match.

- Here’s another good deal: by the definition of the combat zone, you’re getting more special pay (at least hostile fire or imminent danger pay). You lived without that money when you were in the U.S., and you can probably live without spending it in a combat zone. Since it’s tax-free, you can set your MyPay (or Marine OnLine) contribution percentage to 100% to contribute all of it to the TSP.

- Some of you have planned for the next good deal: bonus money. I am not a lawyer or a CPA or a CFP, and you’ll have to read your bonus contracts very carefully to make sure you’re eligible, but here’s the link: if you sign a bonus contract in a combat zone eligible for CZTE pay, then it’s not taxable.

Let’s be clear: I would not volunteer to re-enlist or sign a bonus contract in a combat zone just for the tax-free pay. (Yes, I get reader questions about how to volunteer for this.) I would not even do it to pay off student loans or consumer debt. Yet if you’re planning to obligate the service anyway, or if you’re eligible to sign up for the BRS Continuation Pay bonus between 8-12 years of service, then as long as you’re in the combat zone, you might as well make the most of your pay advantages.

Suddenly, that annual addition limit might be within your reach.

- Here’s another fine-print point that the BRS has highlighted: these annual addition limits are per calendar year, not just for the deployment. Let’s unpack that concept for several more paragraphs.

When you deploy to a combat zone (as defined above), you’re eligible for the annual additions limit for the rest of the calendar year. You’re contributing tax-free pay when you’re in the combat zone, yet you can continue to contribute taxable pay to the TSP after you leave the combat zone.

But there’s a catch, and after I published this post, it took me a couple more e-mails with the TSP to confirm it.

When you return home, any further contributions for the rest of the year are subject (again) to the elective deferral limits. You can not exceed $23,000 of contributions in the Roth TSP at any time during the calendar year. In addition, if your traditional TSP account has already exceeded $23,000 of contributions during the calendar year, you can’t contribute more taxable pay to it.

If you’re in the BRS, you want to receive DoD’s matching contributions all year. To do that, you must leave room in your Roth TSP for all 12 of your monthly contributions. Read the “If You’re In The BRS…” section below to make your plan.

[See the bottom of this post for the verbatim details of the TSP staff’s interpretation of the tax law.]

If your deployment stretches from October 2023 to March 2024 (ouch, over the holidays), then you’re eligible for the annual addition limit of $66,000/year in 2023 and again for $69,000/year in 2024. Your pay was only untaxed while you were in the combat zone, but you get to use the annual additions limit in two calendar years.

Even if you just have a series of short deployments to combat zones during the year, the IRS will still let you use the annual additions limit all year. You’re certainly paying the price for the benefit– use as much of it as you can.

Note that if you’re stationed in Qatar for two years, you may be able to use the annual additions limit in three different calendar years. “See the world” with tax-exempt pay and higher TSP contribution limits.

- Here’s another method that readers have shared with me: sell some investments from your taxable accounts. You’ll want to seek professional tax advice from a CFP or a CPA, but this can save you a lot on capital-gains taxes.

Here’s the theory: your combat-zone income is tax-free, so your taxable income for the year is very low. When you’re in a low income-tax bracket, your tax rate on long-term capital gains is… zero. For example, a married couple filing jointly pays no capital gains tax if their total taxable income is $89,250 or less.

You’ll raise your TSP contributions (in MyPay or Marine OnLine) as high as possible. Meanwhile, you’d sell some of your investments in taxable accounts (within that 0% long-term capital gains limit) and use that money for living expenses. The net result? You’ve shifted a huge amount of money to the TSP and avoided a whole bunch of capital gains taxes.

- One more idea, although it borders on irresponsibility: if you’re a junior officer who’s taken out a career starter loan during college, then I’d be tempted to maximize my TSP contributions and live off the balance of that loan. You’d essentially be borrowing money at 1%-2% per year to invest in the TSP and then paying it back over a longer term. This is extraordinarily risky (high volatility, loss of principle, leveraged debt) but potentially profitable over a decade or longer.

Let’s cover one more piece of fine print about that annual additions limit, and then we’ll get to the example.

The Roth TSP annual contribution limit is still $23,000

(Even when you’re eligible for the higher annual additions limit)

Here’s that crucial fine print where the TSP computers can cut you off:

Here’s another way of saying it, from page #3 of this TSP fact sheet:

Tax-exempt contributions made to the traditional balance of a uniformed services account while deployed to a designated combat zone do not count toward the tax code’s elective deferral limit. However, any Roth TSP contributions are subject to the Internal Revenue Code limit even if they are contributed from tax-exempt pay.”

When you’re contributing to your Roth TSP (and you should), you must stay below the Internal Revenue Code limit ($23,000) until December’s contribution. This means that your overall annual additions limit will stay just under the elective deferral limit in the Roth TSP (with your last contribution of the year coming in December), and the rest of your contributions will go into the traditional TSP. Of course, the DoD BRS agency/match contributions are always going into your traditional TSP (see paragraph 7.b.(12) of that link), so between you and DoD, you’ll end up with the rest of your contributions in your traditional TSP account.

When your Roth TSP contributions hit $23,000, no matter where you are or when it is during the year, the TSP computer system will cut you off. Any excess contributions from your pay will be used to reach the limit, but the TSP will kick the rest of the excess back to DFAS. Even worse, the TSP will shut you down at the elective deferral limit ($23,000) and lock you out of contributions for the rest of the calendar year.

If You’re In The BRS… then leave room in your Roth TSP for your monthly contributions

[This section is a 12 November 2018 update to the original post.]

We already know that you can only contribute to your Roth TSP up to the elective deferral limit. That limit applies at home and in the combat zone.

The TSP has confirmed that when you’re home from the combat zone, you can only contribute to your traditional TSP up to the elective deferral limit. (See the edits above in paragraph #4, and see the TSP e-mail after the end of this post.)

However, while in the combat zone, you did your best to reach the annual additions limit. ($69,000) That means that you probably contributed way more than the elective deferral limit to your traditional TSP while in the combat zone. If you did, then now that you’re home, the TSP computers would have locked out further contributions to the traditional TSP.

If you’re locked out of TSP contributions before the end of the year, you will lose your DoD BRS matching contributions for the rest of the year. You earned a lot of tax-free pay during the deployment and might have reached the annual additions limit in your TSP, yet you still lost out on free money.

However, you can still contribute to your Roth TSP up to its elective deferral limit of $23,000.

The solution: when you set up your plan for your year of TSP contributions, start with 5% of your monthly base pay to the Roth TSP. That ensures you’ll have 12 months of Roth TSP contributions and 12 months of DoD BRS matching contributions.

Then, fill in the rest of your plan using the spreadsheet template below. When you return home, you’ll probably be shut off from more contributions to your traditional TSP. (You’ve already blown through the elective deferral limit in your traditional TSP, and you’re approaching the overall annual additions limit in your TSP.) However, you still have room in your Roth TSP to reach its elective deferral limit before you reach the annual additions limit.

Example: contributing $55,000 in 2018 to the TSP from a combat zone with the DoD BRS match

Note: The following example was initially published in 2018. For consistency, we have left these numbers as they were in the example provided by correspondence with TSP officials. You will need to update this example with your current situation to maximize your contributions.

This example comes from a series of e-mails with the Federal Retirement Thrift Investment Board (the government agency that runs the TSP) and the DoD BRS office.

This is one of the examples used at the FRTIB for the training of TSP employees, and they’re reportedly working on more comprehensive guidance for servicemembers. I’ve already asked the BRS office to connect us bloggers with the FRTIB so that we can continue the conversation and get specific links to the tax code.

The DoD BRS office also asked me to pass on:

Individual service members who are impacted by this should contact the TSP call center or a tax adviser for guidance on the impacts of IRS regulations on their contributions.”

Until we get Now that we have the IRC references and clarifications from the CPAs and the lawyers, please feel free to refer to this post with the DoD BRS office, DFAS, the TSP, and your pay/personnel office. This example is how the system is supposed to work.

At the end of this example, I’ve included a screen capture of a spreadsheet and a link to the Google Sheet where you can tweak your numbers.

Here’s a scenario for a servicemember who:

- Opted into the Blended Retirement System.

- Contributes at least 5% to their TSP every month (for the full DoD matching contributions).

- Deploys to a combat zone to receive combat zone tax-exempt pay…

- … and their deployment is only part of the year (March – September 2018). They’re back home on 1 October 2018.

Here’s the FRTIB response, edited for easier blog post reading:

I think there are many ways that a service member can do this, and I’ll give an example.

Disclaimer: This is not advice but merely an example of one service member contributing while in a combat zone.

Assumptions:

- Service member who makes $48,000/year in basic pay and receives a $30,000 retention bonus while in a combat zone.

- The elective deferral limit is $18,500 and the annual additions limit is $55,000.

Using these numbers, if the service member contributes 5% in January-February and 5% again in October-December, they will have contributed $200 per month of their own money and received agency/matching 5% of $200 per month.

If that happens, the service member will have contributed $1,000 towards the elective deferral limit (their own contributions) and $2,000 towards the annual additions limit (their own contributions and employer contributions).

That leaves the seven months in the combat zone to figure out how to contribute.

In this exact scenario, it likely makes sense to contribute to Roth up to the elective deferral limit less contributions made in January-February and October-December because those contributions will be tax-free going in and tax-free coming out so long as all of the other tax requirements are met.

In that case, there is $17,500 left towards the elective deferral limit ($18,500 minus the $1,000 contributed in the months while not in a combat zone). That divided over seven months is $2,500 per month of which there will be an additional agency/matching 5% contribution of $1,400.

This brings the total contribution to the TSP to $20,900 meaning the service member can contribute an additional $34,100 of tax-exempt money to their traditional account. That amount over a seven month period is $4,871 per month.

These amounts will allow for both the elective deferral and annual additions limit to be reached and the maximum amount of matching to be reached (5% of $48,000).

Of course, this service member could adjust the numbers to increase the contributions while not in a combat zone and decrease the amount while in a combat zone.

However, if the service member reaches the elective deferral limit before they leave the combat zone, they will not be permitted to make any contributions when they return.

Use a Spreadsheet to Model Your Contributions

As you may have concluded by now, that has to be added to a spreadsheet to be clearly understood.

Here’s the link to that Google Sheet for maximizing BRS contributions to the Thrift Savings Plan from a combat zone. Please note that to edit this spreadsheet, you’ll have to copy it (“File | Download as…”) to your device and then edit your copy.

What If You’re Still In The Legacy High Three Pension System?

The rules are still the same for your combat zone contributions; only you don’t have to worry about DoD’s BRS agency or matching contributions.

Remember to stay below the Roth TSP contribution limit, as mentioned in the BRS section. Here’s another way of saying it, from page #3 of this TSP fact sheet:

Tax-exempt contributions made to the traditional balance of a uniformed services account while deployed to a designated combat zone do not count toward the tax code’s elective deferral limit. However, any Roth TSP contributions are subject to the IRC limit even if they are contributed from tax-exempt pay.”

You have to stay below the IRC limit when you’re contributing to your Roth TSP (and you should). ($18,500 in 2018, $19,000 in 2019.) Your annual additions limit ($55K in 2018, $56K in 2019) will put you just short of $18.5K ($19K in 2019) in the Roth TSP. The remaining $36,500.01 of your contributions ($37,000.01 in 2019) will go into the traditional TSP.

[Reader update:

This comment just came in my Facebook messages:

“Hello, I read your article about maximizing TSP in a combat zone. I ran into an issue earlier in 2018. Before deploying in June, I had contributed about $18,300 to traditional TSP and $200 to Roth. When I arrived I was unable to make any more contributions to Roth, but I was able to contribute to Traditional. Why is this?”

My response:

If you contributed $18,500 to the TSP before deploying, you’d already hit the elective deferral limit ($18,500 in 2018) before arriving in the combat zone. The TSP computers and DFAS would have locked you out of further contributions.

Now that you’re deployed, neither the TSP nor DFAS would have automatically restarted your contributions. Perhaps someone from your pay office (or DFAS) noted your combat-zone status and restarted the contributions. Since you had already reached your annual contribution limit (and they had to turn it back on) for some reason the TSP system wouldn’t accept new contributions to the Roth TSP.

I’m sorry this happened. Servicemembers who’ve opted into the new Blended Retirement System are advised not to front-load their TSP contributions so that they can receive the monthly DoD BRS match all year long. This appears to be a similar issue with the TSP computer system.]

Note for “older” servicemembers

If you’re age 50 or older, then you will be able to include a $6,500/year “catch up” contribution.

You active-duty folks shouldn’t smirk at this clarification– you’d be surprised how many Reserve and National Guard servicemembers are in their 50s. That should tell you something about how challenging & fulfilling the Reserve & Guard can be if you’re feeling a little burned-out on active duty.

A Friendly Little Note From The IRS

[19 December 2018 update: see a sample IRS letter a few paragraphs below, at the end of this section.]

Several servicemembers (and their frustrated spouses) have mentioned receiving IRS letters asking the servicemember to verify their deployment to a combat zone. One family was still receiving IRS letters about a 2016 deployment while the servicemember was deployed again in late 2017.

This letter is automatically generated by an IRS computer, which tries to match the tax return to some sort of report that the servicemember has deployed to a combat zone. (Pro tip: this report to the IRS does not seem to come from DoD.) You’re welcome to call the IRS to confirm, but getting a human to help you respond to the letter is not always easy. I’m not sure an IRS human even sees the letter before it’s mailed to you.

Your best response to the letter 2761 request for your combat zone service dates is a written letter. If you want to be proactive, you can send the letter as soon as you return from deployment. (No operational security issues there!) You can also notify the IRS by e-mail about your combat zone service, but again, I’d wait until you’re home for OPSEC. Spencer over at MilitaryMoneyManual also has more suggestions about documentation and tracking the deployment dates. As he suggests, save copies of your Leave and Earnings Statements which cover the duration of the deployment.

The whole point of volunteering this information to the IRS is to give them your information to create an entry in your taxpayer account database telling the agency that you deployed to a combat zone. That way when your tax return arrives at the IRS months later, the computer will already have a flag in the system to confirm your service. Ideally, it won’t spit out a form letter.

Here’s the IRS’s explanation:

Thank you for your e-mail dated Dec. 10, 2018 and the information you sent in response to a 2761C letter.

The Department of Defense (DoD) is supposed to send us a Combat Zone Indicator (it converts to a Combat Zone Extension in our system) for every member of the military that is in a combat zone. The DoD is also supposed to send us a “spousal” indicator if the military member is married. When the military member exits the combat zone the DoD is supposed to send us the exit date.

This system worked well for a couple of decades. Over the past several years the DoD computer system and our computer system have had communication issues. Sometimes we get no indicator when a military member is in a combat zone, sometimes we get the entrance indicator and not the exit indicator, and sometimes we only get a spousal indicator.

The Internal Revenue Service is tasked with keeping accurate records for all taxpayers. To do so, we sometimes have to ask our taxpayers for help.

We apologize for any inconvenience we have caused you and sincerely thank you for helping us clean up our records.

You may be interested in Publication 3 Armed Forces’ Tax Guide. You can view it on our website or order it through our toll-free forms line at 1-800-829-3676 Mon.- Fri 7:00 am – 7:00 pm your local time.

One more special note: an extended deadline to contribute to your IRA

During my research for this post, I learned that you may even be able to contribute to last year’s IRA. Seek professional advice from a CFP or a CPA before you do this.

Your Call To Action:

Once again, if you’ve opted into the BRS, ensure you contribute at least 5% of your base pay to the Thrift Savings Plan for the BRS match. Even if you’re still paying off debt, it makes sense to contribute to your TSP to at least get DoD’s free money in your TSP.

When you know your deployment dates, download that spreadsheet and make your TSP contribution plan. It’d be great to have the income or assets to reach the annual additions limit but do your best.

Whatever you decide to contribute, make sure you stay below an annual contribution of $23,000 in 2024 in the Roth TSP, or you’ll be locked out of additional contributions for that calendar year. When you’re in the BRS, that limit lockout will keep you from earning DoD BRS matching contributions for all 12 months of the year.

[The rest of the story:

The FRTIB’s policy is not clear in the tax code or in the TSP’s pamphlets and website.

I formed this opinion when an AFC and at least three other CFPs could not find a clear reference to the FRTIB’s policy in the tax code or the TSP’s public materials. (Despite one of them having seen the TSP’s training materials about the limits.) However, two servicemembers were already locked out of further TSP contributions in 2018. We knew they’d followed the rules on their Roth TSP limits. That meant there still could have been a glitch in the TSP computer system’s BRS software or that there’d been another mistake with implementing the legislation. Or… the TSP’s guidance on the annual additions limit was ambiguous.

The FRTIB says that it’s not a computer glitch. DoD’s BRS office (and Congress) can decide whether this is the way they want the TSP to work. There’s already been at least one proposal to change the tax code for Reserve/Guard servicemembers in the BRS who have highly-paid civilian jobs with 401(k) plans. My confusion over the annual additions limit would appear to be yet another unintended consequence of the BRS legislation on TSP contributions.

The good news is that the TSP training team has taken aboard our feedback and is updating their Blended Retirement System training materials. I’ll stay in touch with the TSP and with the DoD BRS office.

Here’s the FRTIB’s verbatim interpretation from one of their TSP Training & Liaison Specialists– one of the people handling the TSP’s Education and Outreach program.

“The answer is “no,” this individual already met their 402(g) elective deferral limit, and therefore would no longer be allowed to make contributions to their TSP (contributions that apply to the 415(c) limit and NOT the 402(g) limit are only CZTE pay contributions, so therefore if you are no longer receiving CZTE pay, any contributions apply to the 402(g) limit, which again, was already met).”

Let me break down that 65-word sentence into smaller clauses.

When you return home from the combat zone, you can still contribute to your TSP accounts– but only up to the elective deferral limit ($18,500 in 2018, $19K in 2019) in each account. The TSP’s website and pamphlets are clear on only being able to contribute combat zone tax-exempt pay above the elective deferral limit in the traditional TSP when you’re in the combat zone. However, they’re not so clear on how you can contribute taxable pay to your traditional TSP after you return home.

One of my smarter friends (a military retiree and a CFP) suggested thinking of it this way: when you’re home, count down from the limits instead of counting up. “How much have I reduced my elective deferral limit in each of my TSP accounts? How much room do I have left to contribute to each one?”

Alert readers will note that the servicemember in the contribution spreadsheet example received a $30K retention bonus while in the combat zone. If they signed that contract in the combat zone, then every one of the subsequent annual installments of that bonus is also tax-free… even if they’re not in the combat zone. Could they contribute the next few years’ installments of that CZTE pay to their traditional TSP up to the annual additions limit?

My answer: I don’t know. I’m going to let the FRTIB and the BRS office clarify those interpretations of the tax code. The good news is that DFAS already knows the bonus contract is tax-free and will reflect it on your W-2.]

Military Guide to Financial Independence

This book provides servicemembers, veterans, and their families with a critical roadmap for becoming financially independent. Topics include:

- Military pension

- TSP

- Tricare Health System

- & More

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Todd H says

Doug,

Since dollars contributed in a combat zone are marked as tax exempt anyway (and therefore can be rolled later to a RIRA without ever paying taxes), wouldn’t it be smarter to just switch from whatever regular level of RTSP one was contributing pre-deployment to traditional TSP while deployed?

Then when deployment ends, switch back to RTSP. If dollars contributed to traditional TSP while deployed only count towards the AAL and NOT the EDL, there seems to be zero good reason to contribute to RTSP while deployed. It seems that doing so only complicates things and potentially leaves not enough room in the EDL for remainder of the year after deployment if you do your math wrong (ie inflationary raise in January, time in service pay increase you didn’t anticipate, or a promotion).

Thanks!

Ryan Guina says

Todd,

I can’t speak for Doug, but I’ll share my observations.

Contributing to the Roth TSP in a tax-exempt zone is the best possible situation for investments – the contributions are made with tax free money, it grows tax-free, and withdrawals are tax free. There are no other situations where you can get this in a retirement account.

Traditional TSP contributions made in a tax-exempt zone are made with tax free money, the growth is tax free, but withdrawals are different. Only the contributions can be withdrawn tax-free. The growth is taxed when withdrawn.

Yes, you can transfer the Traditional TSP contributions to a Roth IRA when you leave military service. But you can only transfer the tax-exempt Traditional TSP contributions to a Roth IRA. The growth from those contributions can only be transferred to a Traditional IRA (or you can transfer the growth to a Roth IRA and pay taxes on the growth). To top it off, you may have to wait many years before you are able to transfer the funds. In the meantime, all of the growth from those contributions will be taxable when it is withdrawn in retirement.

The most tax effective way to invest would be to put as much as possible into the Roth TSP without hitting the elective deferral limit, then contributing anything above that to the tax-exempt Traditional TSP. Yes, it requires a lot of planning and there is the risk of making mistakes and missing out on matching contributions or shutting yourself out of the TSP too early in the year. I recommend building a spreadsheet and double-checking your math!

I hope this is helpful!

Pamela Griffin says

Does an individual have to contribute the $20,500 limit to be able to contribute the additional $61,000. Reason for my question is that my client has a civilian employer plan that he wants to contribute the max $20,500 to a 403b. He will be deploying in 2022 and would like to be able to take advantage of the additional $61,000 to his TSP. In order to do so, will he need to NOT contribute to the other plan and just contribute the full $61,000 to his TSP? I understand that the $61,000 max includes employer contributions.

I am thinking that potentially, he can also contribute $61,000 to his 403b as it allows after tax contributions. Thoughts?

Doug Nordman says

Pamela, I’m way outside my circle of competence with 403(b) plans. However if you’re familiar with the differences between 401(k)s and 403(b)s then this post might help:

https://the-military-guide.com/contribution-limits-of-the-thrift-savings-plan-401k-ira/

Note that if your client is in the military Blended Retirement System then they’ll want to make sure they maximize their DoD BRS matching contributions. If they reach the elective deferral limit in their Roth TSP before December then they’ll be locked out of the TSP for the rest of the calendar year. See also Part II of this recent fact sheet:

https://www.tsp.gov/publications/tspfs07.pdf

The TSP has a team of trainers who offer presentations to financial advisors:

https://www.tsp.gov/agency-service-reps/tsp-educational-resources/

I’d contact them and see what other advice they can offer for you.

Andy S. Watson says

This is a great overview, and thanks! Question for you regarding my combat zone balance in my TSP. I have only traditional TSP (no Roth). Retired in 2013. If I were to roll my TSP to another brokerage, what happens to that combat zone balance? I have heard some say they mail you a check? Can that be put in a Roth? Thanks in advance!

Doug Nordman says

John, I’m going to assume that you’re in the legacy High Three pension system and don’t have the Blended Retirement System’s matching contributions in your TSP.

Your plan looks good. As you’ve written, the most important part of your spreadsheet is staying below the elective deferral limit ($19,500 in 2021) before you start earning combat zone tax-exempt pay in October.

Once you’re in country, you should still stay short of the EDL in the Roth TSP. If you hit $19,500 in there then the TSP will lock you out of contributions until 2022. Instead, you’ll put the rest of your 2021 contributions in the traditional TSP.

Doug Nordman says

You’re right, Patrick, your total TSP contributions (both traditional TSP and Roth TSP) are limited to the annual addition limit. If you’re in the Blended Retirement System, the AAL also includes the DoD BRS agency/matching contributions.

https://www.tsp.gov/making-contributions/contribution-limits/

While you were in the combat zone, you could contribute tax-exempt pay to either the Roth TSP or the traditional TSP. However if you reach the Roth TSP’s elective deferral limit any time during the calendar year, then you’re locked out of all further contributions to the TSP (both Roth TSP and traditional TSP) for the rest of the year. This is a software limit in the TSP’s computer system.

Once you leave the combat zone you’re no longer receiving CZTE pay, which means that you can no longer contribute above the EDL in the traditional TSP. You could continue contributing to the Roth TSP up to its elective deferral limit (ideally in December for your 12th month of DoD BRS match). However your total contributions (Roth TSP + traditional TSP + DoD’s BRS agency/matching contributions) are still limited to the AAL.

TSP contributions run on a calendar year, so your final contribution for that year is with the December pay deposit.

The only reason that IRA contributions run until 15 April of the following year is so that taxpayers know their total income for the year (after all the final 1099s, W-2s, and K-1s are received) and can determine their eligibility to contribute to a Roth IRA. If they exceeded the income limits for contributing to a Roth IRA for that year then they could still contribute to a traditional IRA up to 15 April of the following year.

Doug Nordman says

Katie, I’m sorry to read about the problems with the Combat Zone Tax-Exempt contributions. Good work on getting the finance office to correct some of the DFAS problem.

You were in the combat zone on 1 August, so you should still be eligible to contribute CZTE pay to the TSP for the month of August (which should be deducted by DFAS at the end of August and sent to the TSP by early September).

Now that you’re out of the combat zone, your September-December contributions can no longer exceed the total elective deferral limit (the sum of contributions to your Roth TSP and traditional TSP accounts) in the traditional TSP. That can only be done with CZTE pay.

However you can still contribute to your Roth TSP up to the EDL for the final four months of the year. Hopefully DFAS implements your MyPay changes correctly.

Cullen says

Hi Doug,

I’ve read the entire page several times and combed through the TSP website, talked to them on the phone, and talked to DFAS on the phone, and I’m still lost. So, I have another question regarding my specific case, hoping you can shed some light. I’d heard of this, but thought you could only go past the EDL toward the Additional Limit while deployed. I found your article while I was deployed from Feb-May of this year to an eligible combat zone. From Feb-April, I contributed $16,500 into my Roth TSP using my tax-exempt combat zone pay. When I found your article, I shifted by May payment to the traditional TSP hoping I’d be able to continue funding up to the $58,000 Additional Limit once I returned home, for the remainder of 2021. However, on MyPay and speaking to DFAS, they say they have no way of knowing a member is eligible to go past the EDL ($19,500 for 2021) and MyPay will stop withholding the TSP contribution once it says you’ve reached the EDL. The TSP phone rep was not familiar with any of this, and his manager was vaguely familiar but not more than what the website says.

In your opinion, am I only eligible to contribute another $3,000 to the Roth TSP and cutoff there for the rest of 2021, or should I be able to now contribute into the Traditional TSP up to $58,000 for the rest of 2021? Thanks for your help!

John Z says

Hello Doug,

I just got orders, and will be headed to a tax free zone, arriving in October. I normally max out Roth TSP every year with 10 contributions (so then, in terms of money in the bank, it looks like I get a Thanksgiving and Christmas month pay raise/bonus ha!).

I’m playing with the spreadsheet and reading this post and all the comments trying to figure out what I should do to prepare for the October arrival. I had already set up my contributions to follow past years, so there is a fair amount in Roth already. Should I fully stop Roth right now and just do traditional contributions from now to September to get to just below $19,500 in total Roth + TSP balance, then once I arrive in country turn contributions to maximum to fill the Roth limit and whatever excess I can get into traditional up to $58000? Does that sound like a valid plan?

I’ll be there all of 2022, so that makes the math easy for next year, but I’d hate to get “locked out” in 2021 cause I didn’t plan well.

Thanks for any advice.

Jeff says

Hi Doug.

Thanks for a great post. I am in the BRS and plan to max out my Elective and additional deferral. I just arrived in country and have already set up my limits using your spread sheet and ensuring I leave room for 5% Roth for the months that I am back as well as match. I have two questions:

1). If it take 30-60 days for you combat tax exempt status to show up on DFAS will my traditional additional contribution be okay for this month ( first month deployed) or could it possibly be reflect as elective ( and not additional traditional while deployed) and lock me out early from my elective contribution.

2). As a physician my pay is significantly higher than the combat pay exclusion for officers. I am a little confused but if I sign a bonus, I am assuming that would not be tax exempt since my pay is already over the maximum for officers. Is this correct or is there a clause that bonuses don’t count.

Thanks as I look forward to hearing from you.

Jeff

Patrick says

Hi Doug – thanks for tackling a very complicated topic.

You wrote “The TSP has confirmed that when you’re home from the combat zone, then you can only contribute to your traditional TSP up to the elective deferral limit. (See the edits above in paragraph #4, and see the TSP e-mail after the end of this post.) However, while you were in the combat zone you did your best to reach the annual additions limit. ($55K in 2018, $56K in 2019.) That means that while you were in the combat zone you probably contributed way more than the elective deferral limit to your traditional TSP. If you did then now that you’re home, the TSP computers would have locked out further contributions to the traditional TSP.

However, you can still contribute to your Roth TSP up to its elective deferral limit of $18.5K in 2018, $19K in 2019.”

This Roth elective deferral limit is also further limited by the amount that I contribute to the Traditional TSP while I’m in the combat zone. I can’t just blanket contribute 19K in 2019 Roth TSP once I’m home, if my total traditional contributions while in a combat zone were say $50,000. I would now also be limited to only contributing $6,000 into my Roth TSP for the remainder of the year due to the annual additions limit.

Is that right? I just wanted to clarify because it wasn’t entirely clear to me.

Are you able to make contributions to a calendar year TSP limit until April 15th of the following year (like an IRA), or must TSP contributions be made within the calendar year?

v/r

Patrick

Katie Lopez says

Correction: At this point, I’ve contributed $18,150 to my Roth TSP and $3,597 to my Traditinal TSP thru the end of July.

Doug Nordman says

Cullen, when I was writing the post I found that the TSP employees were generally knowledgable, yet they’re not very good at making the vocabulary clear about which limits they’re discussing. (I’ve never talked with DFAS about it.) It took me several conversations with the TSP’s staff CFP (and some revised strikeout text on the blog post) to finally clarify what the law allows.

In this situation, you can contribute another $3000 to your Roth TSP to bring its contributions up to a 2021 total of $19,500. Once the TSP computers reach $19,500 in the Roth TSP then they’ll notify DFAS that the EDL has been reached and DFAS will cut off further TSP contributions for the rest of 2021. In fact if your final Roth TSP contribution brings the total up to $19,501 then the TSP will kick back the final dollar to DFAS and they’ll credit your LES.

The reason is that you can only exceed the elective deferral limit of total TSP contributions (up to the annual addition limit) in the traditional TSP, and only when you’re contributing from combat zone tax-exempt pay. This means you can only exceed an EDL in the combat zone. If you try to do it in the Roth TSP then the TSP computers cut off contributions at the EDL for the rest of the calendar year.

However after you leave the combat zone then you can also continue contributing to the Roth TSP (up to its EDL). You can’t continue up to the AAL (which can only be done with CZTE pay) but you can still reach the Roth TSP’s EDL.

(For BRS readers of this comment: The only difference would be spreading out the remaining $3000 contributions to the Roth TSP to contribute at least 5% of base pay to the Roth TSP for the rest of the months of 2021 in order to obtain the full DoD BRS agency/matching contributions.)

Mahogany says

Hey Doug! Thank you for sharing your knowledge. I typically max out my Roth IRA and my Roth TSP. I’ve not started contributing yet this year, but I’m planning on starting soon. I deploy in July. How much should I contribute now, to max out my contributions, but still be able to max out on the tax-free contributions while deployed? I’m in the legacy retirement system.

Katie Lopez says

Thank you!!

Katie Lopez says

Hi, Doug

I’m currently in the CZTE until September.

If I contribute $18,150 to my Roth TSP in the CZTE, $23,427 to Traditional TSP in the CZTE, and then $441/month to Roth TSP once outside the CZTE in Oct, Nov, and Jan, is there any indication that my account will lock out when I try to contribute in Oct, Nov, Dec?

My calculations do not account for BRS matching contributions.

Doug Nordman says

There are still a few advantages to the Thrift Savings Plan, Wes, and they’re the personal part of personal finance.

First, if you have a window to do a Roth IRA conversion after the military (and before Required Minimum Distributions), then you’ll save quite a bit on income taxes. (You might pay less than long-term capital gains taxes too, especially if income-tax rates go up by the time you’ve reached RMD age.) That conversion opportunity happens when you reach financial independence during your military career and have a very low taxable income after the military. If you have a pension or a bridge career after the military then you can still do smaller annual incremental Roth IRA conversions.

Second, as a retirement account, the TSP offers asset protection for liability, litigation, and bankruptcy. That legal shield isn’t available in taxable accounts.

Finally, the TSP still offers some of the world’s most affordable annuities as part of its RMD withdrawals. That’s not as big a difference today as it used to be 10-20 years ago, and most veterans don’t need additional annuity income, but it’s at a good price for those who want annuity income.

You’re right that the TSP no longer has an edge on expense ratios or the performance of its index funds. That’s more a function of the other fund companies finally catching up with their own offerings.

And yes, with the legacy High Three pension you can load up your Roth TSP contributions from CZTE pay (just short of the elective deferral limit) before switching over to the traditional TSP. You don’t have to worry about receiving matching contributions for all 12 months of the year.

Mike says

Doug, thank you for the informative post. Unfortunately, I’m still struggling with a clear plan for a short-term CZTE deployment that I’m about to go on (February-May 2020, about 4 months). I’ve been successful in maxing contributions to my TSP and an IRA in the past with additional money to various investment accounts.

I guess my question is how should I strategize my contributions considering I will be deployed over the timeframe mentioned above? This is the plan I’m thinking of, but I’m not sure it’s in compliance with the rules mentioned in your post:

Starting 1 January 2021:

-Maximize Roth TSP contributions until I’ve reached the annual elective deferral of $19,500. This probably won’t be achieved until at least July because of the rule that I can only contribute 60% of my base pay.

-Once the annual elective deferral is reached, start contributing to my Traditional TSP toward the annual addition limit. This probably wouldn’t start until at least July 2021, but if I understand your post correctly, I’m still able to contribute to this since it’s the same calendar year that I was deployed in the CZTE area?

Thanks again.

dan says

Hey Mike,

Here are a couple considerations to keep in mind:

1) Once you hit the EDL for the Roth on deployment you can then contribute toward the AAL (the $57K limit) in the Traditional TSP – ***BUT*** ONLY while you remain in the CZTE. Once you leave the CZTE you’re blocked from further TSP contributions for the remainder of the calendar year. Now, if you’re in the Legacy retirement plan (as in you didn’t opt in or weren’t eligible for the BRS) this doesn’t matter, I’d get that tax-exempt pay into the Roth where it’ll grow tax-free forever. BUT if you’re in the BRS then you’ll lose out on the Agency & DoD matching of up to 5% per pay period. So keep that in mind.

2) Even if you’re in the BRS, if you know you can’t max out the EDL for the Roth between JAN-MAY then you can still try and then just spread out the rest of the EDL across JUN-DEC if that’ll give you the 5% contribution per pay period.

3) The way you could contribute > $19,500 to the TSP in 2021 would be to contribute tax-exempt pay into the Traditional TSP and then contribute up to the EDL again in the Roth for the remainder of JUN-DEC 2021. The benefit here is that you get more money into the TSP but the downside is the lack of tax-diversification. Although, if you are deployed 5/12 months for 2021 your taxable income should be pretty low – so that might not matter that much! You might only still pay an extremely low effective tax rate for the year. If that’s your situation, I’d consider that.

What rank are you, if you don’t mind sharing?

Mike says

Thank you for the response. I’m in the legacy retirement system and was not eligible for the BRS. I’m a W2 and dual-military so we benefit from additional allowances.

Mike says

Thank you again, Doug, for the information. After talking to a financial advisor, I think I’m going to contribute as much of my pay to my traditional TSP while I’m deployed and then switch back to Roth when I return in order to maximize my contributions for 2021.

Wes says

Mike and Doug, I’m not sure I understand the advantage of putting any money into the traditional TSP while your pay is CZTE if you are in the legacy top 3 retirement system. Why not take tax free money and just put it in a regular brokerage? Please correct me if I’m wrong but won’t the tax advantages be exactly the same? With the brokerage I will still be contributing tax fee earnings and paying taxes on the capital gains when I take it out just like I will with my traditional TSP. With the brokerage I have more options to invest and for withdrawal. I understand that Roth while CZTE is amazing.

Thanks for your feedback

Katie says

Hi, Doug, thank you for your message.

I wanted to ask for clarification on “no longer being able to exceed the total elective deferral limit (the sum of contributions to Roth TSP and Traditional TSP)”. I have now contributed $18,150 to Roth TSP and $9,454 to Traditional TSP. Is it correct that I can contribute $1,349 total to my Roth TSP between Sep and Dec in order to continue to continue to get my BRS matching and so that TSP doesn’t lock me out?

Doug Nordman says

You have several options, Andy.

If you roll your traditional TSP to a traditional IRA, most of the big brokerages should be able to track your TSP’s tax-exempt contributions. You’d want to check that with smaller brokerages (especially for self-directed IRAs).

If the brokerage (for whatever reason) sends you a check for the tax-exempt balance then you can either keep it (which reduces the compounding in your IRA) or contact your brokerage again to transfer it to your Roth IRA.

The easiest answer is to use one of the big three (Vanguard, Fidelity, or Schwab) and ask them to confirm it in writing.

Regardless of the brokerage, you’ll still keep your LESs and TSP statements to confirm that you have a tax-exempt basis. Even if the brokerage loses your tax-exempt documentation while you’re doing a Roth IRA conversion (or during RMDs from a traditional IRA) you’ll be able to report the correct numbers on your income-tax return and you’ll be able to show why they don’t match the 1099-R.

Doug Nordman says

Yes, Katie, that’s correct! You can contribute an additional $1349 to your Roth TSP to hit $19,499 for 2021.

You can do that even though you already have another $9454 sitting in your traditional TSP, as long as those dollars in that account came from Combat Zone Tax-Exempt pay contributions.

To be absolutely technically correct in the details, you could exceed the Roth TSP EDL with your December contribution. The TSP’s software will take the portion that gets you to exactly $19,500 and will kick back the rest to DFAS.

Just so you know, your December and January LESs will look wrong, but that’s because of the calendar-year timing of the way DFAS sends the contributions to the TSP. DFAS somehow squares that up by the February LES, and the W-2s also have the correct numbers. We’ve seen that confusion every year for at least 15 years.

Doug Nordman says

Yep, Mike, what Dan says in his comment: you can only exceed the elective deferral limit in the traditional TSP, and only with combat zone tax-exempt pay.

If you exceed the elective deferral limit with the total of all your contributions to the TSP (the sum of Roth TSP and traditional TSP contributions) in the combat zone, then once you leave the combat zone (no longer receiving combat zone tax-exempt pay) you’re no longer able to contribute to the traditional TSP.

Even worse, once you hit the elective deferral limit in your Roth TSP ($19,500 in 2021) then the TSP will shut down all contributions for the rest of the calendar year. That’s a hard stop whether you’re in a combat zone or not.

That last paragraph is only a problem if you’re in the Blended Retirement System, where you need to contribute at least 5% of your base pay every month of the year in order to receive the full DoD BRS matching. The solution for those servicemembers is to use the spreadsheet in the post to tailor their own contribution plan to their deployment dates.

Servicemembers in the legacy High Three retirement system can front-load their TSP anytime it makes sense.

Regardless of which pension system you’re in, keep in mind that you’ll probably be getting imminent danger pay or hostile fire pay during the combat zone part of the deployment. That might speed your progress toward the EDL. Even when you’re contributing 60% of your base pay to the Roth TSP, you can still contribute up to 100% of your special pays and bonuses. You can also simultaneously contribute more of your base pay to the traditional TSP.

Contributing combat zone tax-exempt pay to the Roth TSP is the most tax-efficient use of your money, but if you hit the EDL in the Roth TSP then you can’t contribute above the EDL. (That’s the hard stop issue.) The only way to contribute above the EDL is from CZTE pay to the traditional TSP. You have to stop your Roth TSP contributions just short of the EDL (up to $19,499) and continue contributing to the traditional TSP. Once you reach the annual addition limit ($58K in 2021) or once you leave the combat zone (no longer earning CZTE pay) then you can no longer contribute above the EDL to the traditional TSP.

After you leave the combat zone, the AAL is still in effect for the rest of the calendar year. However you can no longer contribute to your traditional TSP because you’re not receiving CZTE pay. What you *can* still do is contribute up to the EDL in the Roth TSP.

Paul M Johnson says

Doug,

Thank you so much for this article.

I have been trying to figure out how to handle TSP contributions while deployed this year going into next year and I’m still concerned I haven’t gotten it 100% figured out. I turn 50 next year which I believe means my max contribution after returning home is $19,500 + $6,500 and my total for TSP contributions next year is $64,500. If I understand correctly I have to get $38,500 in while in the CZTE and have the rest of the year to contribute the $26,000 (I’m not in BRS). My current plan is to get about $19,000 into Roth TSP plus $31,000 in Traditional TSP before I get home. My understanding is that as long as I stay under $26,000 total in Roth TSP I can continue to contribute to Traditional TSP up to the $64,500. However, I’m not quite sure how all the limits will effect each other.

Also, does the catchup have to be Roth if I’m not deployed when I make the contribution? Doe it have to come from base pay?

Doug Nordman says

You’re welcome, Paul, I’m glad it helps!

I’m not a financial advisor, so I’d recommend checking my interpretation of this guidance on the catch-up contribution with a fee-only CFP who’s familiar with military TSP contributions. I realize that’s an issue during a deployment, and if you have bandwidth then I can refer you to a few who work with military families around the globe. Otherwise you’d want to talk with one when you return home.

As you’ve noted, these contributions are annual limits. If you’re deployed in both 2020 and 2021 then you have two different calendar years for your contributions during the same deployment. In 2020 you can contribute up to $19,500 in your Roth TSP and an additional $37.5K from combat zone tax-exempt pay in your traditional TSP.

Because you turn 50 in 2021, you’re not eligible for the catch-up contributions in 2020.

If you’re still in the combat zone in 2021 then your limits reset on 1 January. Now you can contribute another $19,500 to your Roth TSP (all calendar year long) and an additional catch-up contribution of $6500 for a total of $26K. That’s near the bottom of the page of this link, and at the bottom there’s additional guidance for uniformed servicemembers:

https://www.tsp.gov/making-contributions/contribution-types/

As you’ve written, while you’re in the combat zone the catch-up contribution has to go to the Roth TSP:

“If you are a uniformed services member and enter a combat zone, your contributions toward the catch-up limit must be Roth. (The TSP cannot accept traditional tax-exempt contributions toward the catch-up limit.)”

While you’re in the combat zone you can contribute another $38.5K from CZTE pay for the 2021 annual addition limit of $58K.

That link also says:

“You also cannot contribute toward the catch-up limit from incentive pay, special pay, or bonus pay.” You’re right, it has to be from base pay.

However there are also two comments on that link referring to the annual addition limit:

“Once you exceed the elective deferral or annual addition limit, your contributions will spill over and automatically start counting toward the catch-up limit.”

“Note: If you contribute tax-exempt pay, your total contributions from all types of pay must not exceed the IRS annual addition limit for the year.”

I’m not sure how to interpret these two comments. I think they mean that you should stay short of the Roth TSP contribution limit of $26K (elective deferral + catch-up) until you’re back home. Once you hit $26K in the Roth TSP (from any type of pay) then the TSP system will shut down your contributions for the rest of 2021.

While you’re in the combat zone in 2021, though, you can contribute to your traditional TSP up to the annual addition limit of $58K. I interpret this to mean that you have to stay short of the AAL until you return home (and no longer receive CZTE). Once you’re home (still a little short of $58K) then you can contribute the additional $6500 catch-up contribution to the Roth TSP from your base pay.

Daniel Nguyen says

Doug,

Thank you for the great post! I have been trying to get these answers from TSP for months without success. My question is, what is the advantage of putting CZTE money in the traditional TSP to work towards AAL, when it will be taxed when i take it out during retirement?(projected 35% bracket while retired). Would it be better to use that CZTE towards a brokerage account where I will only pay 20% capital gains when I take it out in 30 years or have the flexibility to take it out sooner? I was hoping to hit AAL into Traditional TSP when i got back from deployment to lower tax burden but doesn’t seem like I will be able to. Thanks again!

Doug Nordman says

I’m glad it’s helping, Daniel! The TSP doesn’t seem to have the customer-service staff available to answer these questions individually, but I had a chance to discuss this topic with a CFP on their training staff during the implementation of the Blended Retirement System.

There are still a few reasons to use the Thrift Savings Plan. First, if you have a window to do a Roth IRA conversion after the military (and before Required Minimum Distributions), then you’ll save quite a bit on income taxes. (You might pay less than long-term capital gains taxes too, especially if income-tax rates go up by the time you’ve reached RMD age.) That conversion opportunity happens when you reach financial independence during your military career and have a very low taxable income after the military. If you have a pension or a bridge career after the military then you can still do smaller annual incremental Roth IRA conversions.

Second, as a retirement account, the TSP offers asset protection during liability litigation and bankruptcy. That legal shield isn’t available in taxable accounts.

Third, the TSP still offers some of the world’s most affordable annuities as part of its RMD withdrawals. That’s not as big a difference today as it used to be 10-20 years ago, and most veterans don’t need additional annuity income, but it’s at a good price for those who want annuity income.

You’re right that the TSP no longer has an edge on expense ratios or the performance of its index funds. That’s more a function of the other fund companies finally catching up with their own offerings.

You’re right that you can’t contribute to the traditional TSP after the deployment if you’ve already exceeded the total elective deferral limit in the TSP (combined Roth TSP and traditional TSP contributions) during the deployment. You can only exceed the EDLwith combat zone tax-exempt pay (during the deployment), and after the deployment you’re no longer receiving CZTE. However during the deployment (with CZTE pay) you can get close to the EDL in the Roth TSP and then blow through the EDL in the traditional TSP. Traditional TSP contributions from CZTE pay can take your total TSP contributions all the way up to the AAL, which includes any DoD BRS agency/matching contributions. This is particularly effective if you’re deployed to or stationed in an area where you’re eligible for CZTE for the entire year.

Collin says

Doug,

I think Daniel was asking in his first question what’s the benefit of contributing tax-free combat pay to a Traditional TSP when Trad. TSPs are pre-tax dollars anyways. This would mean that tax-free combat pay would in fact be taxed when you withdraw that money in retirement.

Does TSP “earmark” combat zone pay so it’s not taxed on withdrawal?

Thank you for the help!

Doug Nordman says

Collin, you might be focusing more on the taxes than on the benefits of contributing to a retirement account with ERISA protections.

CZTE pay in the TSP is better than a brokerage account for legal reasons, not just financial, and the tax deferral of the traditional TSP can be handled by a Roth IRA conversion after the military. Even with a bridge career and/or a pension after the military, a vet might be more lighly taxed during a Roth IRA conversion than they’ll be taxed during RMDs.

If that vet reaches financial independence and leaves the military for several years of very low earned income, then they’ll definitely have lower income taxes via a Roth IRA conversion.

Putting CZTE pay in the Roth TSP is constrained by the elective deferral limit. That’s especially the case when the Roth TSP has to stay open for Blended Retirement System servicemembers who are receiving the DoD BRS match by contributing at least 5% of their base pay to the Roth TSP in all 12 months of the year.

Vets who leave the military short of retirement might also find the TSP annuity is worth buying as part of their asset allocation.

Traditional TSP contributions outside of a combat zone are normally pre-tax dollars (tax-deferred until RMDs or Roth IRA conversions). However traditional TSP contributions from CZTE pay aren’t “pre-tax”… they’re totally tax-exempt. They’re exempt going in and they’re exempt going out. There’s no tax to discuss, let alone “pre-” or “post-“. The gains on those tax-exempt contributions will eventually be taxed, but the legal and tax tactics of using the TSP (and a Roth IRA conversion) make the TSP worth the contributions.

The TSP tracks the cost basis from DFAS’s coding, and DFAS also puts those codes on the W-2 for the IRS. CZTE pay tax-exempt contributions (to both the traditional TSP and the Roth TSP) are part of that tracking. Today most IRA custodians will also continue to track that tax-exempt cost basis after rollovers or Roth IRA conversions.

Nick B says

Thanks Doug,

On a separate question in regards to tax planning with the deployed TSP allocation strategy being forefront discussion. Given the scenario above, where the total deployed traditional/exempt TSP contributions of $34,097 are made, would it be assumed that the realized taxable income for the rest of the year would be less than ZERO because pay from Mar-Sept Base pay is non-taxable (7 months =$28,000)? (*Roth contributions are obviously not a factor for tax deductions.) Going even further with the example, with the 2020 standard deduction of $12,400, equals a net taxable yearly income of ZERO since deductions from Traditional Contributions exceed reported W-2 income. So this hypothetical guy making $48,000 (30k Bonus is assumed untaxable in CTZE) would pay zero taxes and might even make money on other EITCs/credits, correct?

We are trying to also make educated tax planning strategies with my deployment since my wife works in the private sector and we make equal taxable incomes. By piling all of base pay into traditional TSP during a deployment, and being in a CTZE it will all help us lower taxable income at the end of the year jointly.

TIA and great advice!

-Nick, Robins AFB

Doug Nordman says

Your scenarios for low taxable income and zero income taxes are quite possible, Nick, because military pay is already lightly taxed. (Even when you’re not receiving combat zone tax-exempt pay.) When a low taxable income is eligible for programs like the Earned Income Tax Credit and child tax credits, you might even get paid to file your income-tax return– or at least carry unused credit forward to the next tax year.

The light taxation of military pay is also why most military families up through the ranks of E-5 and O-3 should contribute to their Roth TSP and Roth IRA. It might even make sense to do so for higher ranks, depending on special/bonus pays or non-military income (spouse careers, taxable investment income, or side hustles).

Keep in mind that when you’re deployed (and receiving CZTE pay) then you do not get a tax deduction or deferral for contributing CZTE pay to your traditional TSP. (That pay is not subject to taxation in the first place, so there’s nothing to deduct. It’s not taxed on withdrawal, either, so there’s no deferral.) When you’re not in a combat zone then you’ll still get a tax deduction for traditional TSP (and possibly traditional IRA) contributions with military pay earned outside of a combat zone. Those traditional TSP and traditional IRA contributions from outside of the combat zone will be deferred from taxation until you withdraw them through Roth IRA conversions or Required Minimum Distributions.

However you’re already lightly taxed and might end up paying zero taxes that year anyway, so instead of traditional TSP/IRA contributions it might make more sense to contribute to a Roth TSP and Roth IRA. That’s why this post focuses on contributing to the Roth TSP outside of the combat zone and to the traditional TSP in the combat zone.

The real benefit of contributing CZTE pay to your traditional TSP is the ability to exceed the elective deferral limit ($19,500 in 2020) and approach the annual addition limit ($57,000 in 2020).

https://www.tsp.gov/PlanParticipation/EligibilityAndContributions/contributionLimits.html

The contributions are tax-free for life, and the higher contribution allows even more tax-deferred compounding. (Unlike taxable investment accounts, where annual distributions might be taxable every year upon receipt.) Although the CZTE pay contributions to the traditional TSP are tax-free, the growth is still subject to tax… eventually.

I’m pretty sure this is why the tax code limits Roth TSP contributions to the EDL no matter where the pay is earned. Otherwise servicemembers would try to contribute $57K of CZTE pay to their Roth TSPs during combat zone deployments and would never be taxed on that growth.

Todd Hunsicker says

Doug,

What a fantastic article and subsequent clarifications. I am truly impressed with your level of detail. If you’ll indulge me, I’d like to clarify if I am correct on #1, A, B, and #2. Thanks in advance!

1)I totally understand the whole “plan out your payments so that you still have room to at least put 5%” but want to clarify that RTSP contributions count toward EDL at ALL TIMES, including during a deployment correct? From reading your article it seems that traditional TSP contributions by a SM also count towards EDL if they are made while not deployed, but WHILE THEY ARE deployed, traditional TSP contributions don’t count towards EDL, but only AAL correct? So someone trying to maximize BRS would want to:

1A-Make sure that they leave room in EDL for non-deployed months to at least put 5% through the each month to the end of the calendar year.

1B-Then make sure that they aren’t going to go over AAL of $55K when adding up everything applicable for EDL plus anything they put into Traditional TSP while deployed plus any matching they might receive

2) Assumptions: Someone in BRS (assume 5% base pay equaled $500 each month across both 2019 and 2020 in this hypothetical scenario) who is deploying to A combat zone on DEC 15th, 2019 until SEP 15th 2020 and will get a $62,000 bonus in both DEC 2019 and JAN 2020 (unrealistic I know, but humor me). They’ve previously put 18,000 into RTSP for the 2019 year (not including DEC contributions). They could: Put $1000 to RTSP for DEC out of their base pay and $31,000 (half) of their bonus intro traditional TSP. This would put their EDL at $19,000 and their AAL at $56,000. Then in JAN 2020, they could put $13,500 of their bonus towards RTSP and $500 of their base pay, simultaneously putting $31,500 into traditional TSP. Then FEB-DEC 2020 they would just put $500 into RTSP each month (to still get match). This means they would hace maximized their match, maximized AAL at $57k for the year, and reached their EDL of $19,500 right at the end of the year correct? This is all assuming that the SM could figure out all the percentages of his base pay, bonuses, etc and that the TSP program wouldn’t limit how much a month.

Thanks in advance. Hope I got all that correct.

Doug Nordman says

That’s all correct, Todd!

The key for BRS servicemembers is starting with the 5% monthly base pay contributions to the Roth TSP, and only reaching the Roth TSP elective deferral limit in December.

Next, since a deployment with Combat Zone Tax-Exempt pay implies a very low income tax that year, they’d want to fill up the rest of the elective deferral limit with more Roth TSP contributions… 20%, 30%, or even more (up to the DFAS MyPay limit of 60%).

Finally, the only way to exceed the annual elective deferral limit is to contribute CZTE pay to the TSP (up to the annual addition limit), which can only be done from… a combat zone. Since the servicemember is probably already set up to maximize their Roth TSP contributions by December, the only remaining room for those additional contributions is in the traditional TSP.

Jeremy Murray says

Doug, I spent 5 months in a ctez but left the tax free zone toward the end of July and returned home in August. I planned on contributing more than the 18500 this year but as soon as I reached the 18500 limit, tsp stopped deducting from my paycheck. I was mostly contributing to roth and specifically changed to traditional once I was near the 18500 limit. Even with changing my contributions to traditional my tsp deductions stopped when I reached the 18500 limit. When I called the tsp help desk number, they told me the additions limit only applied while I was still in the tax free zone. I dont think that is correct. What can I do?

Dennis says

Doug-