Investing. We all know we should do it, but it’s easy to put it off for another day. Why is that? Well, there are several reasons, such as not knowing how or where to invest, or not knowing when to use the services of a professional advisor. Over the next few weeks, we hope to cover all these topics to give you a better idea of how to start investing so you can take care of your long-term financial needs.

Are You Afraid of Investing?

As a personal finance blogger, I’m ashamed to admit this, but the surest way to see me break out in a cold sweat is to ask me what I think of the stock market. I may have an excellent handle on my budget, my income-to-debt ratio and even my savings accounts, but when it comes to my investments, I’m not sure which end of a mutual fund is up.

I am lucky, in that my father is a financial planner and has picked up a great deal of the slack for me, helping me to overcome my fear of investing and to get more involved in my long-term money plans. So, I’m not keeping my retirement fund in my mattress — but only because I have someone who is looking out for my best interests and who is very savvy about what will work for me. However, it’s time for me to face my invest-o-phobia. Here, in the first part of this introduction to investing, are three reasons why you (and I) need to get over our fear and start investing for our future.

Why Should You Invest?

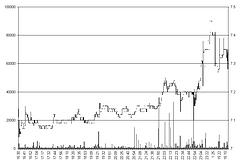

1. Take advantage of compound interest. We’ve all seen the startling charts comparing the compound interest of an investor who started young versus an investor who waited. But it’s important to understand just how much compound interest can and will affect your investment.

Most CDs (certificates of deposit) or government bonds have historically grown at about 5%, though we are presently seeing lower returns. Historically, investing in the stock market will earn you a return of about 10% over the years. The difference between those two types of investments means the difference between a $300+ return on a $100 investment in 25 years and a $1000+ return on the same investment in the same time frame. So no matter how phobic you may be about investing, it really does pay to do your homework and find a strategy that will make compound interest work for you.

2. Retirement is now your responsibility. It used to be that working at the same job for 20 or 30 years guaranteed a pension that would let the golden years take care of themselves. This is still true for military members and workers in some government positions, but unfortunately, pensions in the private sector are few and far between. If you are lucky enough to have a pension, it may or may not be enough for you to live on without another source of income. Even a military pension may not be enough for retirement. (Read more about how much a military pension is worth.) If you want to ensure that your retirement years are not spent eating ramen noodles, you’ll need to take charge of your investments.

3. Only you can know your goals. It would be wonderful if money dropped from the sky any time you might need it. But just like retirement, your life goals are your responsibility — whether you want to be able to pay for your child’s education, a trip around the world or that house on the lake you’ve always dreamed of. Without investing your money to be ready for these goals, they’ll never be more than dreams. Putting your money to work for you in a way that feels comfortable, within your level of risk tolerance, gives you control over your life goals. Stuffing money in a mattress will never give you that level of power.

Next week, we’ll look at ways to invest your money.

Photo credit: graafik

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.